Industry guidance on nature target setting

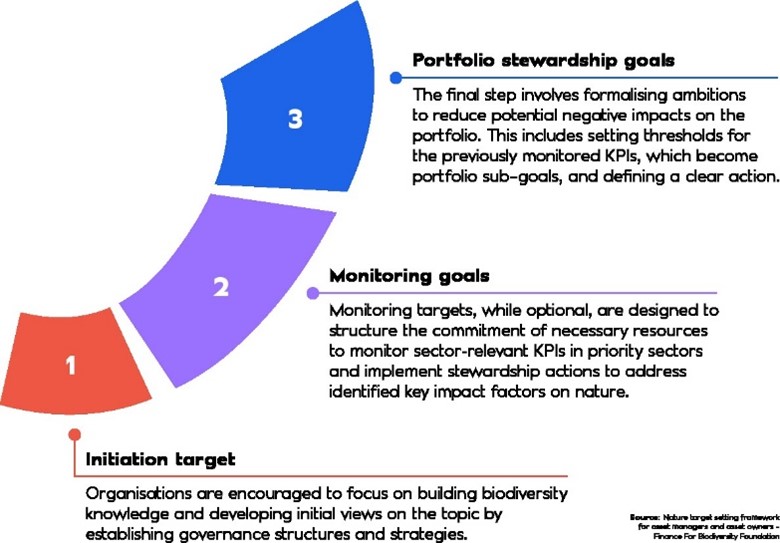

In July 2024, Finance for Biodiversity (FfB) released the second edition of the Nature Target Setting Framework, a guide tailored specifically for asset owners and managers. Its purpose is to help financial institutions navigate the myriad of frameworks available and initiate the process of setting nature-related targets. While the Framework does not prescribe specific methodologies, leaving the choice of goals to individual investors, it provides a shared language and scope for the industry to adopt.

The Framework guides investors in crafting goals that focus on the primary causes of nature-related impacts in their portfolios, using an iterative approach. This starts with initial targets and progresses to portfolio-level targets that include KPIs to support stewardship.

Although specific guidance is emerging, many organisations remain hesitant to set nature-related targets. The reasons are familiar: a perceived lack of robust methods and sufficient data. However, we argue that valuable lessons from the climate journey can accelerate progress in nature target setting.

Four lessons from the climate journey

Setting nature-related targets is undoubtedly complex, much like the early days of climate target setting. Despite the additional challenges nature presents, the climate journey provides valuable insights that can facilitate progress. While there is still a long way to go in the financial sector’s approach to climate, the experiences offer useful guidance on advancing nature targets.

- Just start and share

Many financial institutions (FIs) are committed to making progress, yet real strides in setting nature-related targets remain elusive. A lack of established methods and best practices, particularly regarding stewardship, has resulted in actions that demonstrate good intentions but lack a clear direction. Only a limited number of FIs are willing to take the lead. However, the sector can only advance by developing these methods through practice and openly sharing the knowledge gained.

2. Involve internal stakeholders early

Setting nature-related targets will eventually affect interactions with clients, making the involvement of external stakeholders critical. However, the early stages of developing methods, selecting metrics, and setting targets require strong involvement from internal stakeholders, especially client-facing senior management. Engaging them from the start ensures that they are equipped to work with the targets and fully support the FI’s ambition, rather than wasting valuable time on internal discussions about the feasibility of targets.

3. Be cautious with commitments

Given the evolving nature of methods and metrics, FIs should exercise caution when making public commitments. However, this should not deter efforts to take meaningful next steps. A strategy of under-promising and over-delivering will prove more beneficial, not just for organisations, but also for nature and society as a whole.

4. Convert goodwill into tangible budgets

The need to address biodiversity loss and the material systemic financial risks it poses is undeniable. Almost every executive will agree that action is required, yet goodwill alone is insufficient to drive progress. Currently, climate teams within FIs are often five times larger than their nature teams. To accelerate efforts, reduce negative impacts, make a positive contribution, and seize opportunities, FIs will need to allocate substantial resources and budgets to develop the necessary knowledge and capabilities.

By applying these lessons from the climate journey, financial institutions can begin to take meaningful steps toward setting nature-related targets. While challenges remain, the experience gained in climate target setting provides a roadmap that can guide the sector as it navigates the complexity of nature-related risks and opportunities.

Want to know more?

If you want to discuss how Valcon can help your organisation set nature-related targets, please reach out to [email protected] or [email protected].